In our continuous journey to unravel the market trends and their implications on trade businesses,...

Part 4: The Real Size of HVAC Competitors: Myths vs. Reality

Do you ever look across the street and wonder how large your HVAC competitors really are? Or ponder what 'average' looks like in our industry? In this edition, we're zeroing in on the actual sizes and distributions of trade firms and assessing the looming shadow of Private Equity in our market.

By dispelling myths and unveiling truths, you'll gain a clear picture of where you stand, enabling you to navigate and strategize with confidence.

As a reminder, this email is the fourth in a five-part series examining the broader financial trends affecting the Trades. Click here to find the prior parts.

The chart above breaks down US HVAC and Plumbing firms by headcount. This data is derived from the SBA PPP data from 2020, with firms grouped by headcount to showcase the size segmentation of the market.

From the chart, it's evident that 62% of the market consists of firms with 5 or fewer headcounts. Conversely, the largest firms, with over 100 headcounts, make up just 1% of the total market.

This data is enlightening as it reveals that while large firms may be the most discussed group, they still represent a minimal segment of the market. In contrast, firms with fewer than 5 headcounts dominate, suggesting that the largest cohort of competitors might actually be smaller than you'd expect.

But how does this data inform our understanding of advantages & disadvantages? What some might perceive as a disadvantage (e.g., size) could potentially be a unique strength in disguise.

Once firms surpass the 5 Headcount Club, they grow sufficiently to deploy systems and tools (e.g., ServiceTitan). However, as they expand further, especially beyond 100 Headcount, they start to receive preferential pricing on equipment and parts. Historically, this pricing power, combined with the ability to invest more in marketing, has driven the trend towards scaling and PE rollups. Yet, this outlook is beginning to shift.

Private Equity has been in vogue for a while, but there are clear drawbacks, especially during downturns. These include:

- Variable debt that might be repriced at higher interest rates.

- Mandates to grow to ensure returns for shareholders, especially given the multiples they were initially willing to pay.

- Time-bound investment durations that force many PE funds to exit or recapitalize their stakes within a limited window.

- Additional management layers resulting in elevated overheads.

- Most critically, the absence of hands-on management. In challenging times, having someone to roll up their sleeves and dive in is invaluable.

While being the 100-pound gorilla might seem appealing, it's worth noting that many large private equity firms are currently envying the mid-sized players for their margins and structures. The grass isn't always greener on the other side.

In our next email, we will delve deeper into another critical aspect impacting the financial landscape. Stay tuned.

If you have any questions or concerns feel free to shoot me an email, visit our site @ www.ServiceProCFO.com, or schedule a call with us here

---

ServicePro CFO offers Turnkey Accounting & Finance for Trade Firms using ServiceTitan. Our exclusive focus on ServiceTitan clients means we're deeply attuned to the nuances and intricacies of managing accounting services in the trade industry.

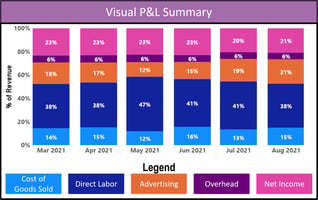

Tired of you P&L sounding like a foreign language? Click below to schedule your free consultation today.

---